Discretionary Trust Deed Sample

A discretionary trust is a trust where the distribution of capital and/or income of the trust to the beneficiaries of the trust is at the discretion of you, the trustee. In a discretionary trust, the trustee has the power to determine which beneficiaries receive the property or assets from the trust and how much each is to receive. The discretionary power of the trustee is limited to a nominated class of beneficiaries that are outlined in the trust.

A discretionary trust has various benefits; most notably, it provides significant asset protection for the beneficiaries. You can use this Discretionary Trust Deed to establish a discretionary trust in any state/territory in Australia. Take a look at our sample below, to get an idea of what yours will look like.

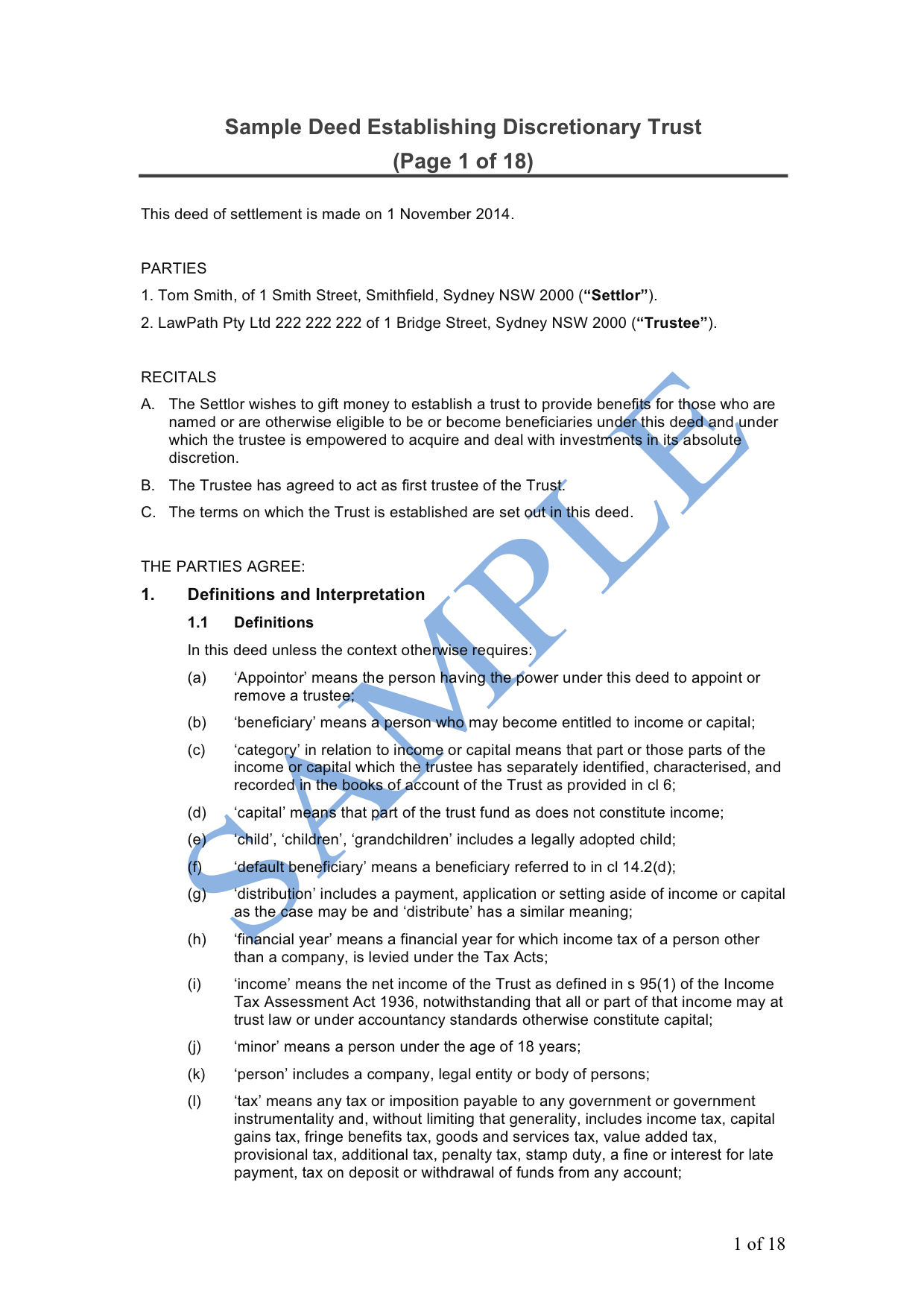

View our Sample

Once customised, your document will look similar to our sample Discretionary Trust Deed.

Get your Discretionary Trust Deed for free.

You can use this Discretionary Trust Deed to establish a discretionary trust in any state/territory in Australia.

What does the Discretionary Trust Deed cover?

Our Discretionary Trust Deed includes clauses setting out:

-

- Establishing the trust;

- Defining the relevant beneficiaries;

- Distribution of income and capital to the beneficiaries;

- Winding up of the trust;

- Appointment of the trustee, including powers, remuneration;

- Removal and appointment of future trustees;

- Responsibility for financial records; and

- A relevant indemnity.

Get a free legal document when you sign up to Lawpath

Sign up for one of our legal plans or get started for free today.