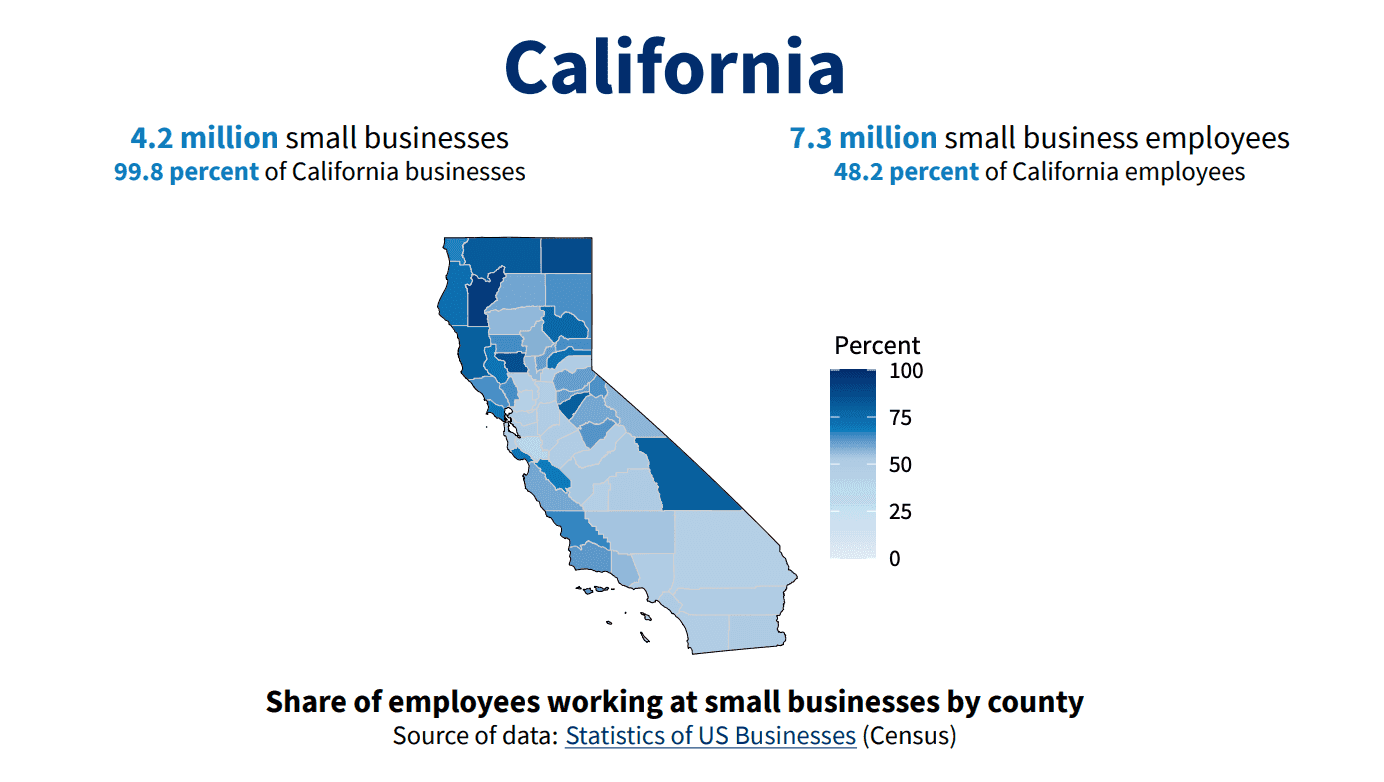

Did you know that California is the state with the highest number of small businesses with over 4 million registered small businesses?

It’s safe to say that starting an online business in California appeals to many—after all, is a land of opportunities!

But whether it is California or any other US state, the truth is that starting an online business is not just overwhelming, it is very competitive too. Not to mention that the brightest ideas don’t always take flight. Sometimes entrepreneurs get caught in the web of legalities as they either don’t fully comprehend it or ignore it till the last minute.

If you’ve been looking at starting an online business in California we can help you every step of the way. We’ve put together the ultimate legal (step-by-step) guide to starting an online business in California to ensure your business dreams become a reality.

Ready to get started?

Read along!

Table of Contents

Section 1: Steps required to starting an online business in California

Before you get into the finer details, it’s important to establish the key steps first.

1. Choose a business idea

The first step involved in starting an online business in California is coming up with a great business idea. If you already have something in mind you’re passionate about, that is excellent news.

But if you don’t yet have that business in mind, that’s also okay. Now’s the time to figure it out, and here are some tips to get started. Think about:

- Market research – What is the problem that needs to be resolved

- Focus on an idea that you’re passionate about

- Great ideas come with creativity. Don’t hold back!

- Conduct a brainstorming session with friends and family

Are you looking to hire an employee?

Use our "Hire an employee" workflow to complete and check off all your legal requirements

2. Name your Californian business

If you already have a business name in mind, that is fantastic. But if you need a little bit of assistance, we have some tips for you. Let’s go through them.

- Your business name should be worth remembering and needs to stand out

- Implement rhymes. For example, Mars Cars, Book Nook, etc.

- Choose a business name with the same first letter. For example, Nelly’s Nails, Sammy’s Sandwich.

- Your business name could reflect your product and its benefits.

- Have a business name that is easy to pronounce.

- A positive connotation for potential customers is always a good idea.

Once you figure out the perfect business name, you need to ensure that it is available for use in California. To do this, you need to search it on California Business Search using the following website https://businesssearch.sos.ca.gov/.

3. Create a business plan

The third step to starting an online business in California is creating a business plan. Business plans are the foundation of any successful business. It can help you stay focused during the startup process, and it will likely be required when you apply for a business loan.

Essentially a business plan is an important tool for understanding how each element of your business will work together to make it a success. You can use it to:

- Monitor progress

- Hold yourself accountable

- Control the businesses’ financials

- Great sales and recruiting tool for courting key employees and future investors

While writing a business plan may seem intimidating in starting a company in California, it’s not as complicated as you might think.

4. Choose a business structure

We can’t stress enough the importance of choosing the right business structure when starting an online business in California.

Each business structure has its advantages and disadvantages, so it’s important to understand each structure in detail before making a decision.

Four common types of business structures in California are:

- Sole proprietorships

- Partnership

- Limited liability companies (LLC)

- Corporations

Let’s go through each business structure in more detail.

1. Sole proprietorship

If you operate your business as an individual in California, you are a sole proprietor. This means that you are legally responsible for all aspects of the business and are accountable for any debts or losses.

In short, you will be running your business under your own name (personal name). So, the main features of a sole trader are:

- As a small business owner, you are your own boss, and you’re self-employed.

- Unlimited liability– this means you are personally responsible for all the debts of your business.

- Sole means trading alone and not using a company structure.

- The owner is usually the manager of the business – You will have complete control over your business assets, business plans, and business decisions.

- California law treats you and your business as one person.

Advantages

Why would you choose to operate as a sole trader? Well, there are endless advantages. Some include:

- It is the simplest structure available in California

- Setting up as a sole trader is easy and inexpensive

- You get to keep all of your business profits

- Great structure for an entrepreneur who is providing an individual service or product, like an accountant.

Disadvantages

Just with any business structure, some disadvantages are:

- Your personal assets can be used to pay business debts since there’s no distinction between business and personal assets.

- Capital is difficult to raise in this business structure

- The business structure is rigid; therefore, it will not accommodate an expanding business.

Setting up a sole proprietorship

If you choose to set up a sole proprietorship, here are the necessary legal and registration steps.

- Choose your business name

- File a fictitious business name statement – California requires you to file a fictitious business name in the country clerk’s office if you use a business name that is different from your first name and surname. This is also sometimes called a DBA (doing business as), assumed name, or trade name.

- Obtaining an employee identification number – An Employer Identification Number (EIN) or Federal Tax ID Number is used by the IRS to identify your California business for tax purposes. There is no filing fee. It serves a similar purpose to your personal Social Security Number except for your business. However, if you don’t plan on hiring employees for your business, you can skip this step.

- Filing requirements – You need to complete Form 540 for tax purposes in California.

- Business income and expenses – Form 1040 is required to report your business’s income and expenses.

2. Partnership

Put simply, a Californian partnership arises when 2 or more people co-operate the business and share the income.

It is a simple and common way to run a business with other parties. Similar to a sole proprietorship, a partnership isn’t a separate legal entity. This means that the partners are responsible and personally liable for any business activity and wrongdoing.

Advantages

If you’re thinking of forming a partnership, the benefits of this business structure are:

- Unlike a sole trader, you will have people to bounce ideas off and who are equally committed to the success of the business

- It’s cheaper and easier to set up

- More capital is available, and you’ll have increased borrowing capacity.

- The business affairs of the partnership are private

- If circumstances change and a partnership is no longer a right fit, you can change the business structure

Disadvantages

The disadvantages of a partnership are:

- You’re responsible for all of the debts and taxes of your business.

- Shared responsibility for the actions and mistakes of other partners.

- You’ll be taking joint responsibility for the business’s debts.

- It’s difficult to change business structures.

Setting up a partnership

If you and your partner are ready to set up your online business in California, the steps you should take to form a partnership are:

- Choose a business name

- File a fictitious business name statement – California requires you to file a fictitious business name in the office of the country clerk’s office if you use a business name that is different from the first name and surname of the individual partners.

- Draft and sign a partnership agreement – A partnership agreement will ensure that you and your partner will not have any misunderstandings.

- Obtain licenses, permits, and zoning clearances – Depending on the type of business you are engaged in, you may need to obtain business or professional licenses. Visit CalGold, a service of the California Governor’s Office of Business and Economic Development, to find out more.

- Obtain an Employer Identification Number – This is the same EIN as a sole proprietorship step if you choose to have employees in your business.

3. Corporation

The third option to choose from is a corporation. The corporate structure will separate you from your business, meaning that your personal assets are protected from financial and legal liabilities.

Advantages

If you choose a corporate structure, you will enjoy the following benefits:

- Corporate structure businesses in California typically enjoy a lower tax rate than individuals.

- Corporations can issue stock which means you can raise funds from investors for expansion or development.

- Companies can enter into contracts as themselves.

- This business type is ideal for businesses looking to expand and scale.

- This structure is for you if you plan on raising funds from investors.

- You have liability protection.

Disadvantages

Just like the other business structures discussed, some of the disadvantages of the corporate structure are:

- Setting up a company is more difficult, time-consuming, and expensive compared to the other business structures.

- Corporations require a lot of administrative work compared to other business structures.

- Registration fees are high.

Setting up a corporation

The steps required in setting up a corporation are:

- File a fictitious business name statement if you use a business name that is different from the first name and surname.

- Register for an EIN if you hire an employee.

- You must file Articles of Incorporation with the California Secretary of State – This document outlines the details of your company, such as the business name, location, and for-profit status.

- Choose a registered agent – Your registered agent receives court documents on your behalf if your corporation is involved in legal proceedings.

- Prepare corporate bylaws – Corporate bylaws define how your corporation is structured and governed. Corporate bylaws include information regarding:

- Annual meetings

- Minimum number of voting board members

- Document handling

- Stock

- Directors

- Conflicts of interest

Elect directors and hold board meetings – Every corporation needs a board of directors. In California, there are diversity requirements around the composition of your board of directors. This includes corporations with head offices located in California that must have at least one female board member and board members from underrepresented communities. File a Statement of Information with the California Secretary of State.Pay state tax – Corporations in California are subject to an annual tax administered by the California Franchise Tax Board.

4. Limited liability company (LLC)

Limited Liability Companies (LLCs) combine the advantages of corporations and sole proprietorships. If you plan on starting a small or medium business, or if you want to start your business with legal protection, an LLC may be a good choice for you.

Advantages

The key advantages of LLCs are:

- Reduced administrative burden

- Some legal protection from debts and liabilities

- Relatively easy to manage

- No double taxation – Your LLC’s profits will ‘flow through’ to your personal tax return.

Disadvantages

- Not available to businesses in every industry

- Subject to both state and federal tax

- Requires additional filling out of forms

Setting up an LLC

If you choose to set up an LLC when starting an online business in California, the steps include:

- File a fictitious business name statement if you use a business name that is different from the first name and surname of the individual partners.

- LLCs are required to register for an EIN.

- You must file Articles of Organization with the California Secretary of State.

- Register your LLC – register your LLC with the California Secretary of State by filing a Statement of Information online, using the California bizfile service.

- Choose a registered agent – Similar to a corporate structure, you need to choose your registered agent.

- Pay state tax – LLCs in California are subject to an annual tax that is administered by the California Franchise Tax Board.

- Prepare an operating agreement – The operating agreement is a document that will outline how your online business will operate, how it’s managed, and how profits are allocated.

5. File your business with the CA Secretary of State

Whichever business structure you choose when starting an online business in California, you will need to register your business formation documents with the California Secretary of State. Each business structure has its own form and costs. They are:

- California LLC – The cost to form a California LLC is $70, and you are to use Form LLC-1)

- California Corporation – This costs $100, and you need to use form Form ARTS-GS.

- California Sole Proprietorship or Partnership – You don’t have to file a formation document with the state; however, you have the option to do so for $70.

If you have any questions about registering a business entity in California, you can contact the Secretary of State at 916-653–3794 or through their main website.

6. Open a business bank account

Once you have selected your preferred business structure for your online business, the next step is opening a separate business bank account and getting a business debit card (or business credit card) for your Californian business.

The reason it’s important to do this is that:

- Separates your personal assets from your business assets

- It is easier to manage your accounting and financial matters

- Minimizes the chances of courts piercing the corporate veil

7. Obtain a business license and permits

Next up on your starting an online business in California is obtaining a business license and permits. Not all businesses will require a license or a permit, and it will depend on what industry and location in California you will run your business. For example, the following industries require licenses:

- Radio and television broadcasting – Federal Communications Commission

- Transportation and logistics – US Department of Transportation

- Alcohol – Alcohol and Tobacco Tax and Trade Bureau and Local Alcohol Beverage Control Board

- Agriculture – US Department of Agriculture

Additionally, some cities in California require businesses to have a business license in order to operate. For example, companies in Los Angeles need to register their business with the Los Angeles Office of Finance.

If you are starting an online business, most of these licenses and permits will not apply to you, but it’s important to know about them if you change your business down the track or offer additional products and services.

8. Register for taxes

There may also be federal government, state, and local taxes that need to be registered for your Californian business. As a business owner, you’ll need to collect sales tax on the products you sell. Taxes will vary depending on:

- What type of business structure you choose

- Who owns your business

- Where it’s located

- The industry you’re in

- How you make money

Taxes in California are regulated by four agencies:

- California Franchise Tax Board – handles state income tax and business taxes

- California Department of Tax and Fee Administration – handles sales and use tax, fuel, and other taxes.

- California Employment Development Department – handles payroll tax.

- California State Board of Equalization – handles property tax, alcoholic beverage tax, and tax on insurers’ programs.

It may be difficult to understand all your taxing requirements, so it’s recommended that you work with an accountant to understand your taxing obligations.

9. Examine business insurance options

Even if your business is protected by an LLC or corporation, it’s a good idea to secure insurance. There is plenty of guidance available from the California Department of Insurance regarding

- What kind of insurance you might need for your operation

- General liability

- Professional liability

- Workers’ compensation

Section 2: Setting up your website or blog

Once your sole proprietorship, partnership, LLC, or corporation is registered, it’s time to prepare for launch by getting your business ready to show off to the public. This requires setting up the website for your online business.

Your business website is an important part of how you communicate with customers today. It will play an essential role in the success of your business, so it’s important to ensure it’s set up correctly, and you’re covering all grounds of your website legally.

Here are the key steps that you should be aware of.

1. Set up your website

- Design and set up your website – Setting up a good-looking website is important as this is your first impression for your audiences.

- Trademark your intellectual property – As a business grows in value, often its most valuable assets end up being its intellectual property. This is because once your business gets underway, customers will associate your trademarks with your business. Protect your intellectual property by registering a Trademark.

- Learn how to create a copyright notice to protect your website content.

- Consider any measures required for international sales – It is important to understand the American and foreign laws that apply to international sales, in particular, export controls, consumer protection laws, and tax provisions.

- Create a Website Design Development Agreement – A Website Development Agreement will allow you to commission an external party to design and develop your business’s website.

2. Business and legal requirements

Once you set up your new website, there are certain business and legal requirements to be aware of when starting an online business in California. These include:

1. Creating website terms and conditions of use

There are two types of terms and conditions to be aware of which are:

1. Website Terms of Use

Website Terms of Use also known as online terms of use set forth the terms and conditions that will govern users’ access to your website and acceptable uses of your website’s services. Some important things to be aware of in regards to website terms of use are:

- It does not include a privacy policy, which is contemplated as a separate document.

- If you use Lawpaths Website terms of use, it is not intended for use by a website used by individuals under the age of 13.

2. Terms and Conditions for Online Sales or Website Terms and Conditions

Terms and Conditions for Online Sales, also known as Website Terms and Conditions or E-Commerce Terms and Conditions are used for the online sale of goods and related services by retailers to consumers.

Although they might sound the same, each type covers a different area of your website. If you want to learn more about the differences, you can read our latest post here.

2. Create a Services Agreement (Pro-Provider)

This agreement is governed by California Law and is used for specific projects or ongoing services such as the delivery of a range of services provided either through a website or sold through a website. Whilst this document is not a legal requirement, it will be useful to have when setting up your new website.

3. Domain Registration

The third part requires you to choose a platform for your website and to register a website domain.

Having your own domain name gives your business a unique online identifier and provides many advantages for your online business or service.

A domain name can help protect your brand as it prevents anyone else from registering the same one for as long as you continue to renew it.

4. Privacy

Starting an online business in California means that your website will be collecting customer information. For this reason, it’s very important to ensure that privacy is at the top of your mind for you and your customers.

To ensure this happens, here are two legal documents that will make privacy for your online business a breeze.

1. Create a GDPR and CCPA Privacy Policy

A Privacy Policy outlines how your business will use, store and collect your customers’ information. You must use a Privacy Policy if your business or company collects personal information data online or directly from your customers.

The GDPR or the General Data Protection Regulation is the toughest data privacy law in the world and also came into force in 2018. It is applicable to all businesses operating either within a European member state or outside the E.U. that process personal data of E.U. residents. This is why the GDPR is relevant for businesses operating in the United States, not just in Europe.

The CCPA or California Privacy Rights Act is applicable to businesses operating within California, which they handle the information of California residents.

2. Create a COPPA Privacy Policy

This COPPA-compliant privacy policy is required by federal law wherever the website may be accessed by children younger than 13 years.

5. Online Payments

One of the most important things consumers look for now is the ability to make payments online swiftly and conveniently. Some ways to set up an online payment for your online business include:

1. Setting up a payment gateway

When setting up your website to accept payments online, the first option you want to consider is having a payment gateway. A payment gateway is a merchant or business service that allows credit card payments to be processed. This is commonly used for e-commerce stores and traditional retail businesses.

2. Set up a merchant account with your bank

Another route you may wish to take is setting up a merchant account with your bank. A merchant account is a bank account that allows businesses to accept different kinds of payments, mainly through debit or credit cards. If you’re planning to do this, you’ll need to communicate with your bank that you want to set up a merchant facility.

3. Third-party online payment providers

The main difference between this and the other online payment options is that you don’t need your own merchant account. So, you eliminate the setup and monthly fees you would pay if you had a merchant account. You’ll be dealing with what’s called a ‘third party payment processor’ who serves as a middle-man, and you pay a processing fee. They already have established a relationship with a merchant services provider.

Section 3: Market and brand your business

This last section is all about how you can best market and brand your online business, so everyone across California and the United States is aware of your business. There are a few ways to ensure that this is done effectively. Let’s go through them.

1. Brand your business on your website

Branding is what people see when they hear about your business, so they can identify its value and personality. Branding your online business in the best way possible will differentiate your online business from all the other online businesses.

For this reason, it’s very important that you take extra care when you think about how you want your business’s brand to be perceived by your customers. You can think about the following elements:

- Visual elements – logo, official colors, imagery

- Text elements – slogan, tag line, voice, fonts

- Intangibles – like positioning, brand persona

- Personalize your website theme

- Match your colors to your products, services, and print materials

- Use great product photos and images that engage users visually

- A site map that outlines the page structure

- Include your public contact information

Having a website will be very helpful for your Californian small business. It gives your company a professional feel and allows people to learn about your products and services.

2. Marketing Plan

Promoting your online business is a very important step. You can ensure this is done effectively by implementing a marketing plan. A marketing plan will help:

- You get your product or service in front of the right potential customers

- Keep your strategy on track

- Make sure your brand is being used to the fullest extent possible

- Provides your business’s mission statement

- Details the specific things you want to achieve through your online business

3. Growing and maintaining your website

The last part is continuing to grow and maintain your website. This can be done through search engine optimization.

Search Engine Optimization (SEO) is the process of increasing a Webpage’s quality and quantity of traffic through what’s called unpaid ‘organic search engines’.

You might be asking yourself, ‘why should I care about SEO?’ Well, to put it simply, if you want to increase your brand’s exposure and stand out from your competitors, then you’ll want to learn the basics of SEO

Frequently asked questions (FAQs)

How long does it take to start a business in California?

Starting a business can take a few days for a sole proprietorship or two months or more for a corporation. The complexity of your business structure and operational requirements, such as permits and licenses, will determine the time required.

How much does it cost to start a business in California?

In the case of a sole proprietorship, you might be able to start a business in California for less than $100 USD. The costs of getting started might be several hundred dollars or more, depending on the nature of your business and the permits and licenses required.

Conclusion

If you had a look at all the key steps required to start your online business in California, you are on the right track to making your online business dreams a reality. To summarize the key steps for you, they were:

- Choosing a business idea and naming your business

- Create a business plan

- Choose a business structure

- File your Business with the CA Secretary of State

- Opening a Business Bank Account and obtaining the relevant licenses

- Register for taxes and examine the insurance options available

- Set up your website legally

- Marketing and branding your business

- Growing and maintaining your website

If you’re ready to start building your online business today, Lawpath’s e-commerce business workflow will help you start the right way.

Do you want to start your own website?

Use our "Start a Website" workflow to complete and check off all your legal requirements.